Intro

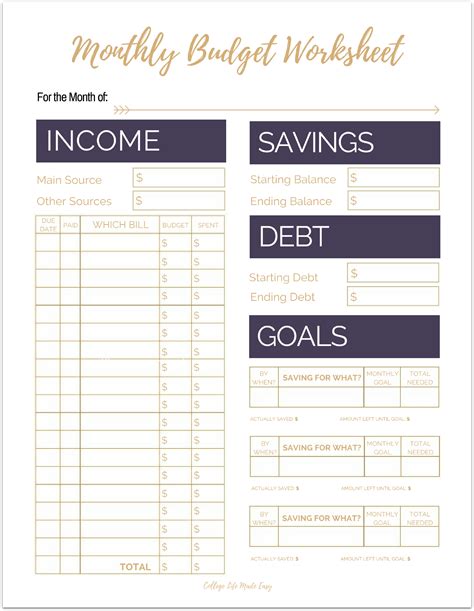

Create a personalized financial plan with free printable budget worksheets, featuring expense trackers, income calculators, and savings templates to manage finances effectively.

Managing finances effectively is crucial for achieving financial stability and security. One of the most efficient ways to monitor and control expenses is by using a budget. A budget helps in planning income and expenses, ensuring that an individual or a family lives within their means. For those who prefer a hands-on approach or need a straightforward method to track their finances, free printable budget worksheets are an excellent resource. These worksheets provide a structured format to record income, categorize expenses, and set financial goals.

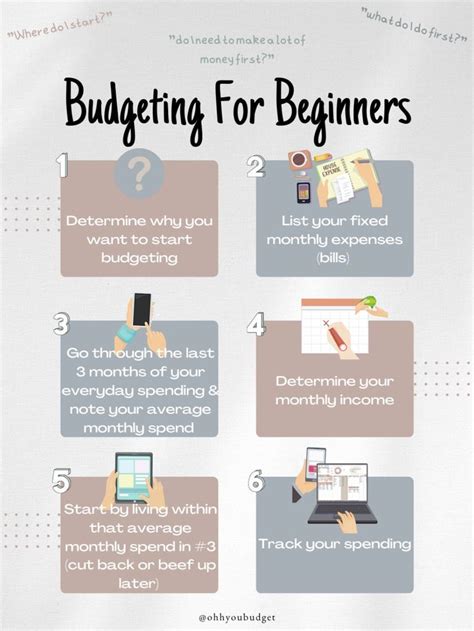

Creating a budget can seem daunting, especially for those who are new to managing their finances. However, with the right tools, it can be a straightforward and empowering process. Free printable budget worksheets are designed to simplify budgeting by providing pre-set categories for income and expenses, making it easier to visualize where money is going and identify areas for improvement. They are particularly useful for individuals who prefer tangible documents over digital budgeting apps or spreadsheets.

Budgeting is not just about cutting back on unnecessary expenses; it's also about making conscious financial decisions that align with personal and financial goals. Whether the goal is to save for a down payment on a house, pay off debt, or build an emergency fund, a budget is the first step towards achieving financial success. Free printable budget worksheets can be tailored to fit individual needs, making them a versatile tool for anyone looking to take control of their finances.

Benefits of Using Free Printable Budget Worksheets

Using free printable budget worksheets offers several benefits, including ease of use, customization, and the ability to track progress over time. They are especially beneficial for those who are visually oriented, as they provide a clear picture of income and expenses. These worksheets can also serve as a educational tool, helping individuals understand the importance of budgeting and how it impacts their financial health.

One of the significant advantages of printable budget worksheets is their accessibility. They can be used by anyone, regardless of their comfort level with technology. This makes them an excellent option for seniors or individuals in areas with limited internet access. Furthermore, because they are printable, they can be used anywhere, at any time, providing a convenient method for tracking finances on the go.

Types of Free Printable Budget Worksheets

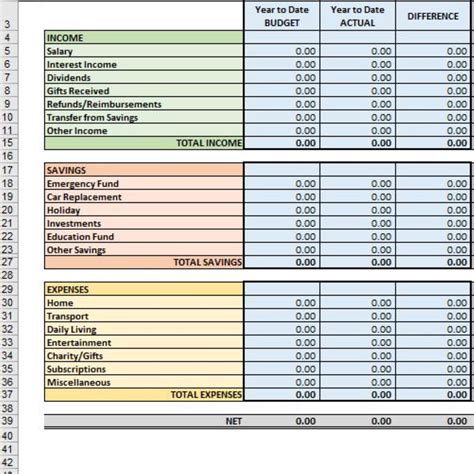

There are various types of free printable budget worksheets available, catering to different financial needs and preferences. Some of the most common include: - Monthly budget worksheets: Ideal for tracking income and expenses over a month. - Weekly budget worksheets: Useful for those who get paid weekly or need to monitor their spending more closely. - Budget worksheets for specific expenses: Such as worksheets for tracking holiday expenses, back-to-school costs, or wedding budgets. - 50/30/20 budget worksheets: Based on the rule where 50% of income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.How to Use Free Printable Budget Worksheets Effectively

To get the most out of free printable budget worksheets, it's essential to use them consistently and accurately. Here are some steps to follow:

- Identify Income: Start by calculating all sources of income. This includes salary, investments, and any side hustles.

- Categorize Expenses: Divide expenses into categories such as housing, transportation, food, entertainment, and savings.

- Set Financial Goals: Determine what you want to achieve through budgeting, whether it's saving for a specific purpose or reducing debt.

- Track Expenses: Throughout the month, write down every expense, no matter how small, in the appropriate category.

- Review and Adjust: At the end of the month, review the budget to see where adjustments can be made to better meet financial goals.

Tips for Effective Budgeting

- **Be Realistic**: Don't set yourself up for failure by creating a budget that is too strict or unrealistic. - **Automate Savings**: Set up automatic transfers to savings or investment accounts to make saving easier and less prone to being neglected. - **Regularly Review Budget**: Financial situations can change, so it's crucial to regularly review and update the budget to ensure it remains relevant and effective.Customizing Free Printable Budget Worksheets

One of the advantages of free printable budget worksheets is their ability to be customized. Whether it's adding specific categories, changing the layout, or incorporating personal financial goals, customization makes these worksheets more effective for individual use. For example, someone with a variable income might need a worksheet that accounts for fluctuations in income, while a family might need categories for childcare expenses or education savings.

Customization can be as simple as writing in categories that are not pre-printed or as complex as creating an entirely new layout. The key is to make the worksheet work for the individual's specific financial situation and goals. This might involve combining elements from different worksheets or adding personal reminders and motivational quotes to keep budgeting on track.

Common Budgeting Mistakes to Avoid

- **Not Accounting for Irregular Expenses**: Failing to budget for expenses that occur irregularly, such as car maintenance or property taxes. - **Underestimating Expenses**: Not accurately estimating expenses, leading to budget shortfalls. - **Not Prioritizing Needs Over Wants**: Failing to distinguish between necessary expenses and discretionary spending.Free Printable Budget Worksheets for Specific Needs

There are free printable budget worksheets designed for specific financial needs or situations, such as:

- Budgeting for Couples: Worksheets that help couples combine their finances and plan for joint financial goals.

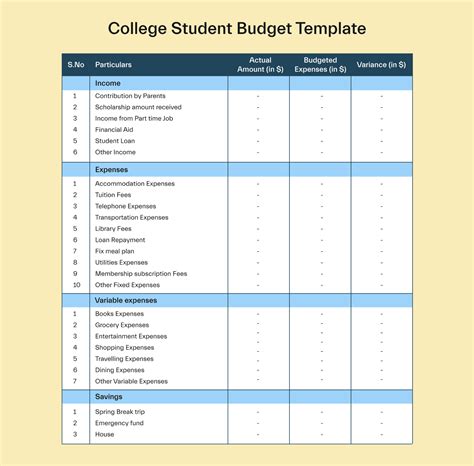

- Budgeting for Students: Designed for students, these worksheets often include categories for tuition, textbooks, and living expenses.

- Budgeting for Retirement: For those planning for or already in retirement, these worksheets help in managing retirement income and expenses.

Using Budget Worksheets in Conjunction with Other Financial Tools

Budget worksheets can be used alongside other financial tools, such as budgeting apps or spreadsheets, to enhance financial management. For example, using a budgeting app to track daily expenses and then transferring the data to a printable worksheet for a more detailed review.Conclusion and Next Steps

In conclusion, free printable budget worksheets are a valuable resource for anyone looking to manage their finances more effectively. They offer a straightforward, accessible way to track income and expenses, set financial goals, and make conscious decisions about spending. By understanding the benefits, types, and how to use these worksheets, individuals can take the first step towards achieving financial stability and security.

For those ready to start their budgeting journey, the next steps involve finding the right worksheet, customizing it to fit specific needs, and committing to regular use and review. With persistence and the right tools, managing finances can become less daunting, and achieving financial goals can become a reality.

Free Printable Budget Worksheets Image Gallery

What are the benefits of using free printable budget worksheets?

+The benefits include ease of use, customization, and the ability to track progress over time, making them an excellent tool for managing finances effectively.

How do I choose the right free printable budget worksheet for my needs?

+Consider your income type, expenses, and financial goals. Choose a worksheet that caters to your specific situation, such as worksheets for monthly budgeting, students, or retirement planning.

Can I use free printable budget worksheets in conjunction with other financial tools?

+Yes, using budget worksheets alongside budgeting apps or spreadsheets can enhance financial management by providing a comprehensive view of your finances.

We hope this comprehensive guide to free printable budget worksheets has been informative and helpful. If you have any further questions or would like to share your experiences with budgeting, please don't hesitate to comment below. Sharing this article with others who might benefit from learning about effective budgeting strategies is also appreciated. Together, we can work towards achieving financial stability and security.