Intro

Discover 5 RCBC calendar tips to optimize banking, including online scheduling, bill payments, and account management, with related services like fund transfers and loan applications.

Remaining organized and on top of tasks is essential for success in both personal and professional life. One tool that can help achieve this is a calendar, and for those associated with RCBC (Rizal Commercial Banking Corporation), having a well-managed RCBC calendar is crucial. Here are some tips on how to make the most out of your RCBC calendar, ensuring that you stay on track with your financial tasks and appointments.

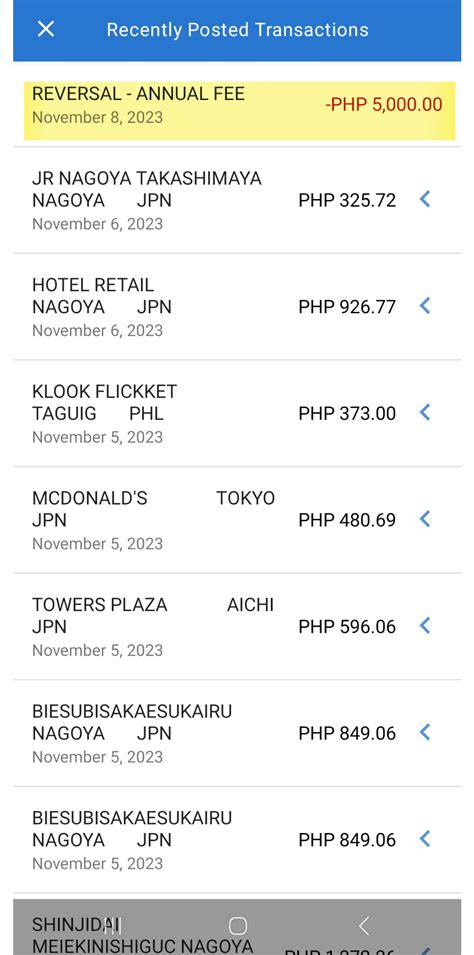

Effective time management is key to achieving your goals, whether they are related to your banking needs, business operations, or personal finance. A calendar, especially one tailored to the operations and schedules of RCBC, can be a powerful tool in organizing your day, week, and month. By integrating your banking schedule, such as payment due dates, branch hours, and special banking holidays, into your calendar, you can avoid missed payments, overdue fees, and the inconvenience of visiting a branch on a day it's closed.

Understanding how to utilize your RCBC calendar efficiently can also help in planning for future financial commitments. For instance, if you're aware of the exact dates when your bills are due, you can plan your finances accordingly, ensuring that you have sufficient funds in your account to cover all your obligations. This proactive approach to financial management can help prevent unnecessary charges and protect your credit score.

In today's digital age, there are numerous calendar options available, ranging from traditional physical calendars to digital apps that can be accessed on your smartphone or computer. Choosing a calendar that fits your lifestyle and preferences is the first step in effectively using it to manage your RCBC-related tasks and appointments. For those who prefer a more tactile approach, a physical calendar can provide a visual reminder of upcoming events and deadlines. On the other hand, digital calendars offer the convenience of accessibility from anywhere, reminders, and the ability to share events with others.

Utilizing Your RCBC Calendar Effectively

To get the most out of your RCBC calendar, it's essential to understand its full potential and how it can be tailored to meet your specific needs. This includes not just marking down important dates like bill payments and banking holidays but also using it to plan long-term financial goals, such as saving for a big purchase or planning for retirement. By integrating both short-term tasks and long-term goals into your calendar, you create a comprehensive roadmap for your financial journey.

Setting Reminders and Notifications

One of the most useful features of digital calendars is the ability to set reminders and notifications. For RCBC calendar users, this can be particularly beneficial for staying on top of payment due dates, upcoming bank closures, or special promotions and services offered by RCBC. By setting reminders a few days before an event or deadline, you can ensure that you're always prepared and never caught off guard by unexpected banking needs.Integrating Your RCBC Calendar with Other Tools

For maximum efficiency, consider integrating your RCBC calendar with other organizational tools and apps you use. This could include budgeting apps, email calendars, or even social media platforms. By syncing these tools, you can create a unified system where all your financial and personal tasks are accessible from one place, reducing the likelihood of overlooking important dates or deadlines.

Customizing Your Calendar View

Customization is another key feature of effective calendar use. Whether you prefer a weekly view, monthly spread, or daily agenda, being able to tailor your calendar's appearance to your needs can significantly enhance its usefulness. For RCBC calendar users, customizing the view can help in focusing on specific financial tasks or appointments, making it easier to manage your banking activities.Sharing Your RCBC Calendar

In some cases, sharing your calendar can be beneficial, especially for business owners or those managing family finances. By sharing your RCBC calendar with relevant parties, such as business partners or family members, you can ensure that everyone is on the same page regarding financial commitments and appointments. This can reduce misunderstandings and missed payments, promoting a smoother financial operation.

Security and Privacy

When sharing your calendar, it's crucial to consider security and privacy. Ensure that you're sharing your calendar with trusted individuals and that you're using secure methods to do so. Most digital calendar apps offer privacy settings that allow you to control what information is shared and with whom, providing an additional layer of protection for your financial data.Maintaining Your RCBC Calendar

Regular maintenance is necessary to keep your RCBC calendar up-to-date and effective. This includes regularly reviewing upcoming events, updating new information, and archiving past entries. By keeping your calendar organized and current, you can ensure that it remains a valuable tool in your financial management arsenal.

Reviewing and Adjusting

Periodically reviewing your calendar and adjusting it as necessary is also important. Financial needs and schedules can change, and your calendar should reflect these changes. Whether it's adjusting payment dates, adding new banking services, or removing outdated information, regular reviews help in keeping your calendar relevant and useful.Conclusion and Future Planning

In conclusion, an RCBC calendar is more than just a tool for keeping track of dates; it's a comprehensive system for managing your financial life. By understanding how to use it effectively, integrating it with other tools, customizing its view, sharing it when necessary, maintaining its accuracy, and regularly reviewing it, you can maximize its potential and achieve better control over your financial commitments and goals.

Looking Forward

Looking forward, the key to successful financial management with your RCBC calendar is consistency and adaptability. As your financial needs evolve, your calendar should evolve with them. Whether you're planning for a significant purchase, saving for retirement, or simply aiming to improve your financial stability, your RCBC calendar can be a trusted companion every step of the way.RCBC Calendar Image Gallery

How do I set up my RCBC calendar?

+To set up your RCBC calendar, start by choosing a calendar type that suits your needs, whether physical or digital. Then, input all your RCBC-related dates, including payment due dates, branch hours, and any upcoming banking holidays. Finally, customize your calendar view to make it easier to focus on your financial tasks.

Can I share my RCBC calendar with others?

+Yes, you can share your RCBC calendar with others, especially if you're managing finances for a business or family. Most digital calendars allow you to share your calendar with specific individuals, controlling what information they can see. This feature can help in coordinating financial activities and ensuring everyone is aware of important dates and deadlines.

How often should I review my RCBC calendar?

+It's recommended to review your RCBC calendar regularly, ideally on a weekly or monthly basis, depending on your financial activity level. This review helps in updating new information, archiving past entries, and ensuring that your calendar remains a current and useful tool for managing your finances.

We hope this comprehensive guide to utilizing your RCBC calendar has been informative and helpful. By applying these tips and strategies, you can enhance your financial management skills, ensuring that you're always on top of your banking needs and appointments. Don't hesitate to reach out with any further questions or to share your experiences with using an RCBC calendar for your financial planning. Your feedback and insights are invaluable in helping others achieve their financial goals.