Intro

Unlock the secrets of the S&P 500 system, a benchmark for US stock market performance. Learn how this free-float market capitalization-weighted index works, its components, and impact on global finance. Discover the benefits of tracking the S&P 500, its correlation with the overall economy, and how it influences investment strategies.

Investing in the stock market can be a complex and daunting task, especially for those who are new to the world of finance. With so many different indices, stocks, and investment options available, it can be difficult to know where to start. One of the most well-known and widely followed stock market indices is the S&P 500. But what exactly is the S&P 500, and how does it work?

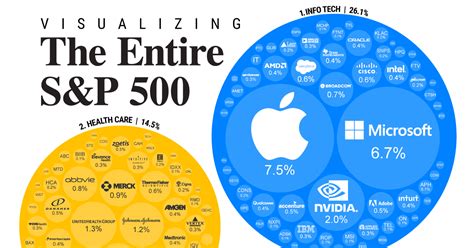

The S&P 500, also known as the Standard & Poor's 500, is a stock market index that represents the market value of 500 large, publicly traded companies in the United States. The index is widely considered to be a leading indicator of the overall health of the US stock market and economy. It is a market-capitalization-weighted index, which means that the companies with the largest market capitalization have a greater influence on the index's performance.

History of the S&P 500

The S&P 500 was first introduced in 1957 by Standard & Poor's, a leading provider of financial information and analysis. The index was created to provide a representative sample of the US stock market, and it has since become one of the most widely followed and respected stock market indices in the world.

The S&P 500 has undergone several changes over the years, including the addition of new companies and the removal of others. The index is reviewed and rebalanced quarterly to ensure that it remains representative of the US stock market.

How the S&P 500 Works

The S&P 500 is a market-capitalization-weighted index, which means that the companies with the largest market capitalization have a greater influence on the index's performance. The index is calculated and maintained by S&P Dow Jones Indices, a division of S&P Global.

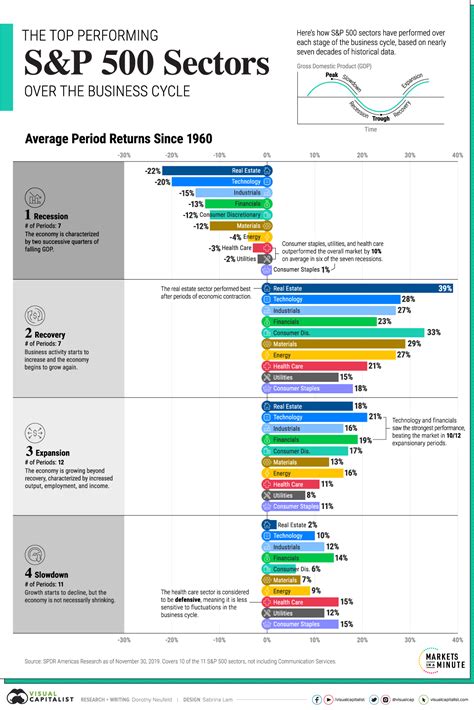

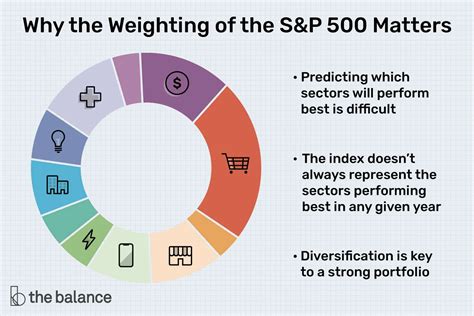

The S&P 500 is designed to be a representative sample of the US stock market, and it includes companies from a wide range of industries, including technology, healthcare, finance, and consumer goods. The index is divided into 11 sectors, each of which represents a different industry or sector of the economy.

Benefits of Investing in the S&P 500

Investing in the S&P 500 can provide several benefits, including:

- Diversification: By investing in the S&P 500, you can gain exposure to a wide range of companies and industries, which can help to reduce your risk and increase your potential returns.

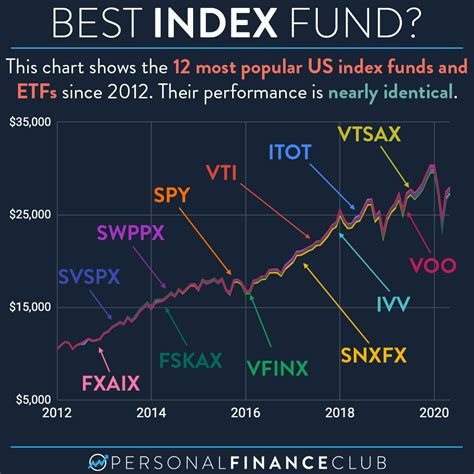

- Low costs: Investing in the S&P 500 can be a low-cost way to gain exposure to the US stock market, as index funds and ETFs that track the S&P 500 often have lower fees than actively managed funds.

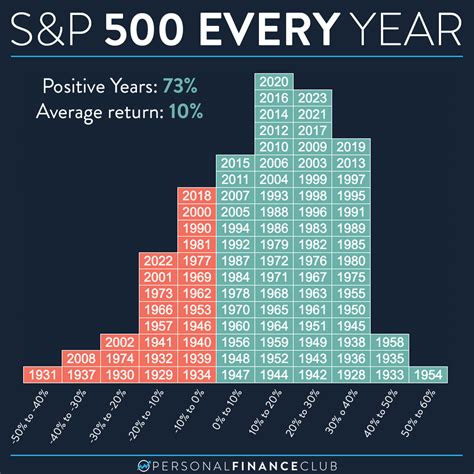

- Long-term growth: The S&P 500 has a long history of providing strong long-term growth, making it a popular choice for investors who are looking to grow their wealth over time.

- Liquidity: The S&P 500 is a widely traded index, which means that you can easily buy and sell shares of an S&P 500 index fund or ETF.

Investing in the S&P 500

There are several ways to invest in the S&P 500, including:

- Index funds: Index funds are designed to track the performance of the S&P 500, and they often have lower fees than actively managed funds.

- ETFs: ETFs (exchange-traded funds) are similar to index funds, but they trade on an exchange like stocks, which means that you can buy and sell them throughout the day.

- Individual stocks: You can also invest in the S&P 500 by buying individual stocks of the companies that are included in the index.

Risks and Considerations

While investing in the S&P 500 can provide several benefits, there are also some risks and considerations to keep in mind, including:

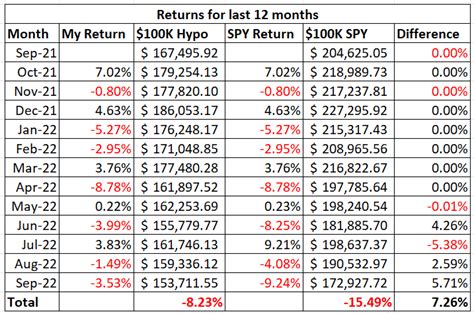

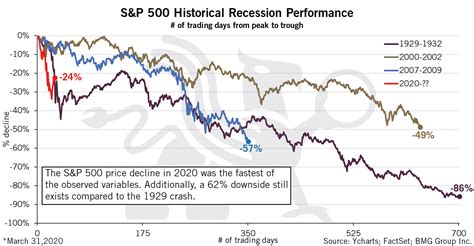

- Market volatility: The S&P 500 can be volatile, which means that the value of your investment can fluctuate rapidly.

- Company-specific risk: While the S&P 500 is a diversified index, it is still possible for individual companies to experience difficulties, which can affect the performance of the index.

- Economic risk: The S&P 500 is closely tied to the US economy, which means that economic downturns can affect the performance of the index.

Conclusion

In conclusion, the S&P 500 is a widely followed and respected stock market index that provides a representative sample of the US stock market. By investing in the S&P 500, you can gain exposure to a wide range of companies and industries, which can help to reduce your risk and increase your potential returns. However, it's also important to keep in mind the risks and considerations associated with investing in the S&P 500, and to carefully consider your investment goals and risk tolerance before making a decision.

We would love to hear your thoughts on investing in the S&P 500. Share your experiences and insights in the comments below!

S&P 500 Image Gallery

What is the S&P 500?

+The S&P 500, also known as the Standard & Poor's 500, is a stock market index that represents the market value of 500 large, publicly traded companies in the United States.

How does the S&P 500 work?

+The S&P 500 is a market-capitalization-weighted index, which means that the companies with the largest market capitalization have a greater influence on the index's performance.

What are the benefits of investing in the S&P 500?

+Investing in the S&P 500 can provide several benefits, including diversification, low costs, long-term growth, and liquidity.