Intro

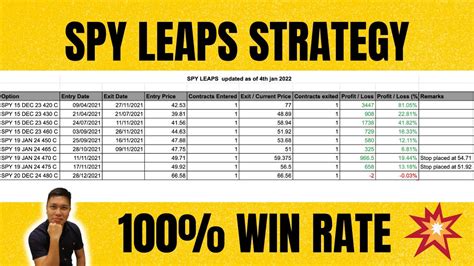

Discover 5 ways to use Spy Leaps Calendar Spread for options trading, including volatility, hedging, and income strategies, to maximize profits and minimize risk in financial markets with calendar spreads.

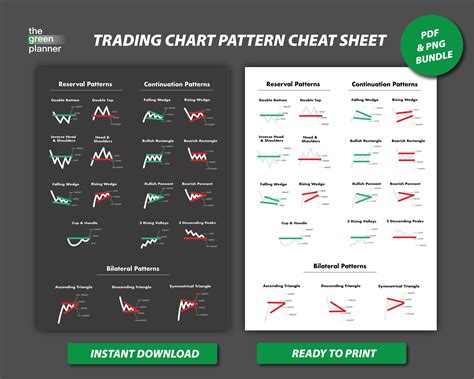

The world of finance and trading is complex and multifaceted, with numerous strategies and tools available to traders and investors. One such strategy that has gained popularity in recent years is the Spy Leaps Calendar Spread. This strategy involves using options to profit from the difference in price between two different expiration dates of the same underlying asset. In this article, we will delve into the world of Spy Leaps Calendar Spreads, exploring what they are, how they work, and the benefits and risks associated with them.

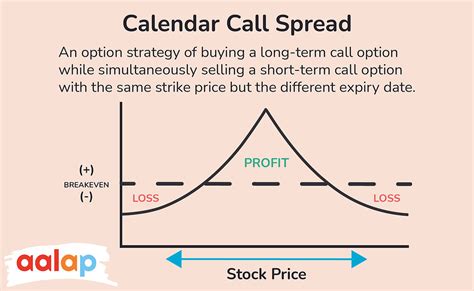

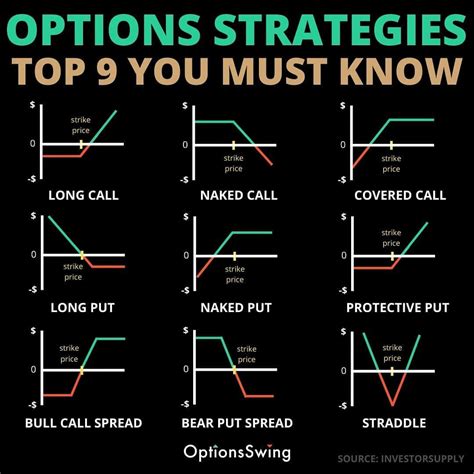

The Spy Leaps Calendar Spread is a type of options trading strategy that involves buying and selling options with different expiration dates. The term "Spy" refers to the SPDR S&P 500 ETF Trust, which is an exchange-traded fund that tracks the S&P 500 index. Leaps, on the other hand, refer to Long-Term Equity Anticipation Securities, which are options with expiration dates that are longer than one year. By combining these two concepts, traders can create a calendar spread that allows them to profit from the difference in price between two different expiration dates.

What is a Spy Leaps Calendar Spread?

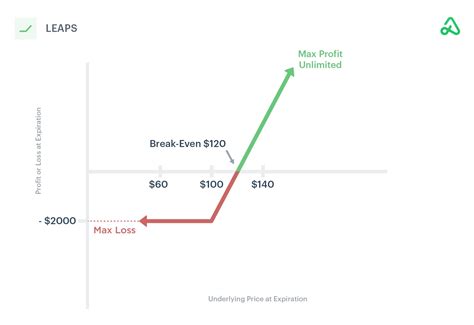

How Does a Spy Leaps Calendar Spread Work?

Benefits of a Spy Leaps Calendar Spread

Risks of a Spy Leaps Calendar Spread

5 Ways to Use a Spy Leaps Calendar Spread

Gallery of Spy Leaps Calendar Spread

Spy Leaps Calendar Spread Image Gallery

What is a Spy Leaps Calendar Spread?

+A Spy Leaps Calendar Spread is a type of options trading strategy that involves buying and selling options with different expiration dates.

How does a Spy Leaps Calendar Spread work?

+A Spy Leaps Calendar Spread works by taking advantage of the difference in time decay between two options.

What are the benefits of using a Spy Leaps Calendar Spread?

+The benefits of using a Spy Leaps Calendar Spread include profiting from the difference in time decay between two options and hedging against potential losses.

In conclusion, the Spy Leaps Calendar Spread is a complex and sophisticated options trading strategy that requires a high degree of knowledge and expertise. While it can be a lucrative strategy, it also comes with several risks, including the potential for significant losses. Traders who are considering using a Spy Leaps Calendar Spread should carefully weigh the potential benefits and risks and should seek the advice of a qualified financial advisor before making any investment decisions. By understanding the intricacies of the Spy Leaps Calendar Spread and using it effectively, traders can potentially profit from the difference in time decay between two options and achieve their investment goals. We invite you to share your thoughts and experiences with the Spy Leaps Calendar Spread in the comments section below.