Intro

Discover 5 ways to access W9 form printable, including IRS downloads, online templates, and tax software, to simplify independent contractor tax reporting and compliance with 1099 forms and self-employment taxes.

The W9 form is a crucial document for businesses and individuals alike, as it provides essential information for tax purposes. In today's digital age, having access to a W9 form printable can be incredibly convenient. Whether you're a freelancer, independent contractor, or business owner, understanding the importance of the W9 form and how to obtain a printable version can save you time and hassle. In this article, we'll delve into the world of W9 forms, exploring their significance, benefits, and providing guidance on how to access a W9 form printable.

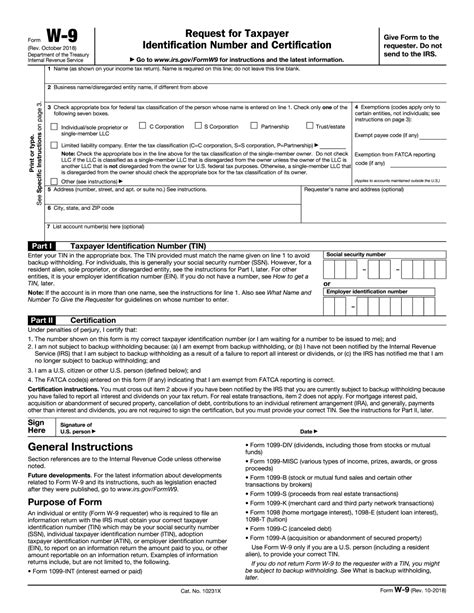

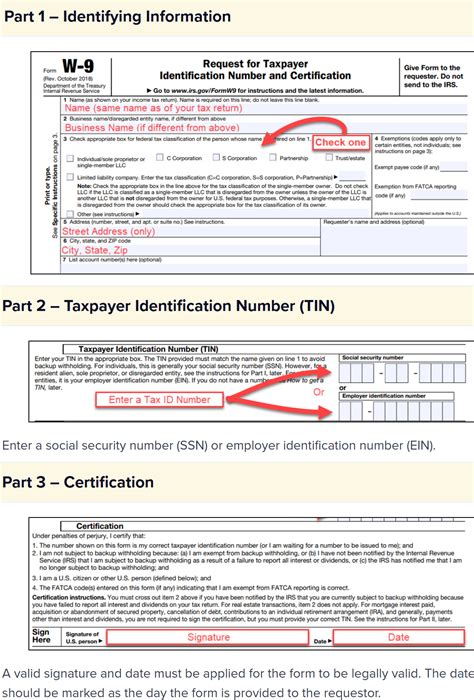

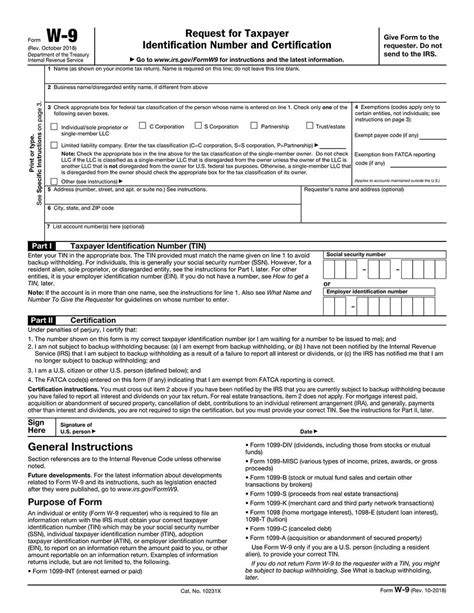

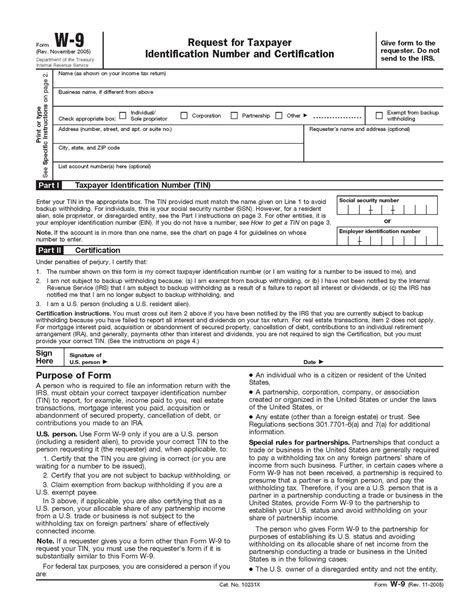

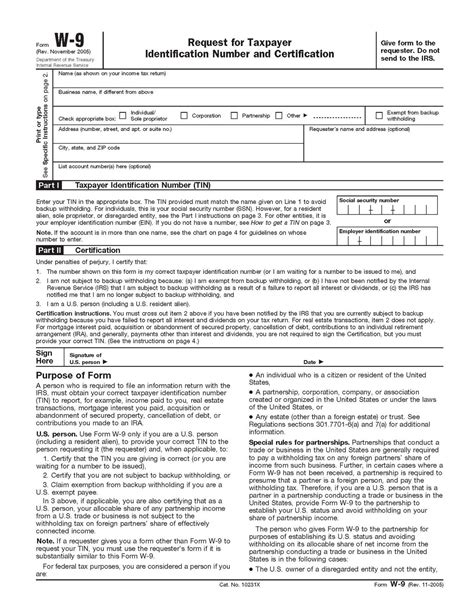

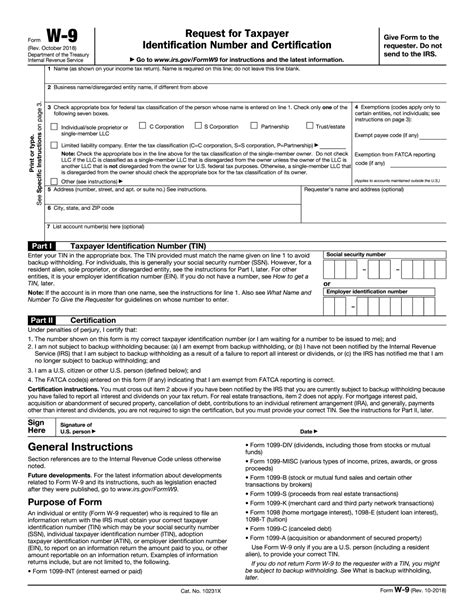

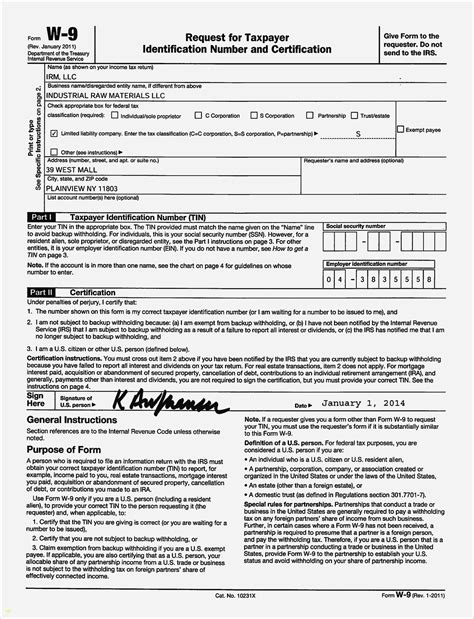

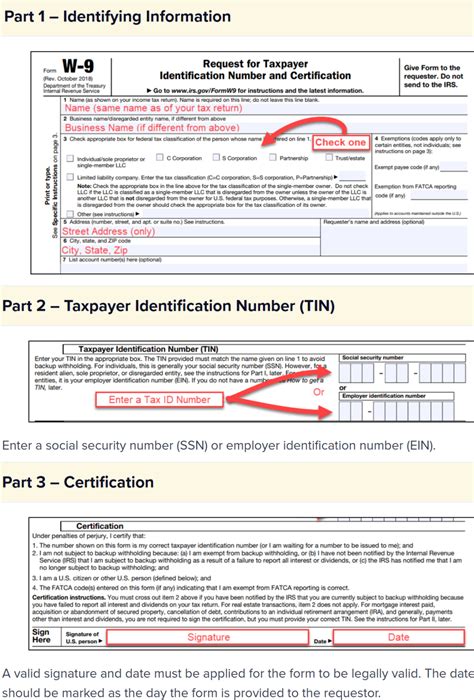

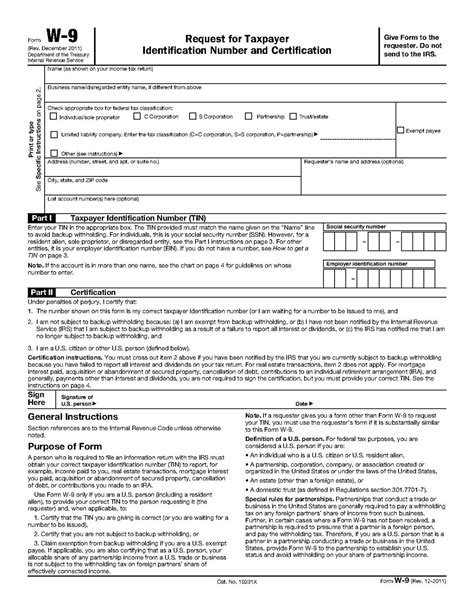

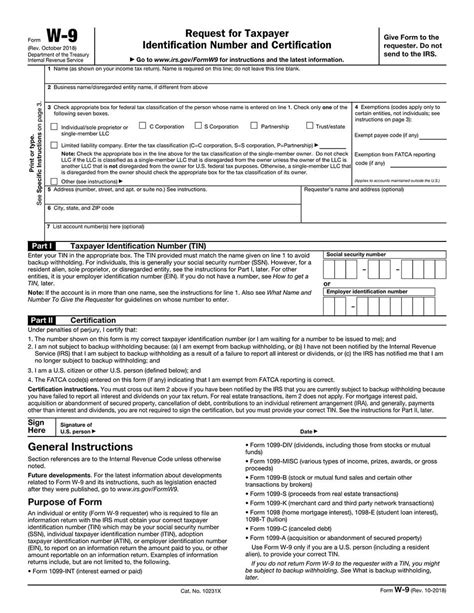

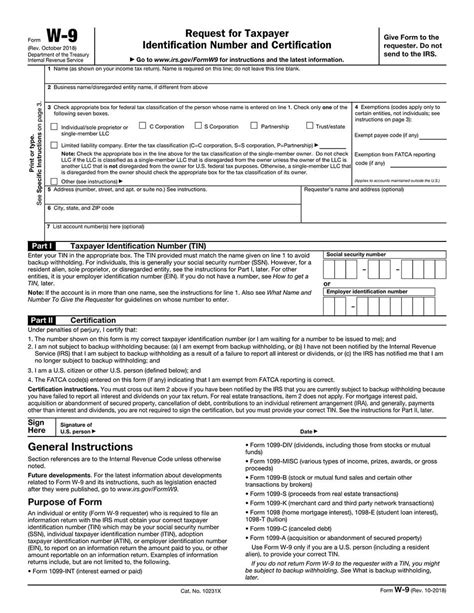

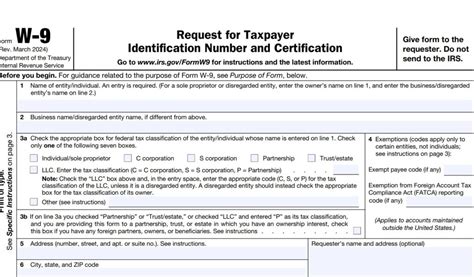

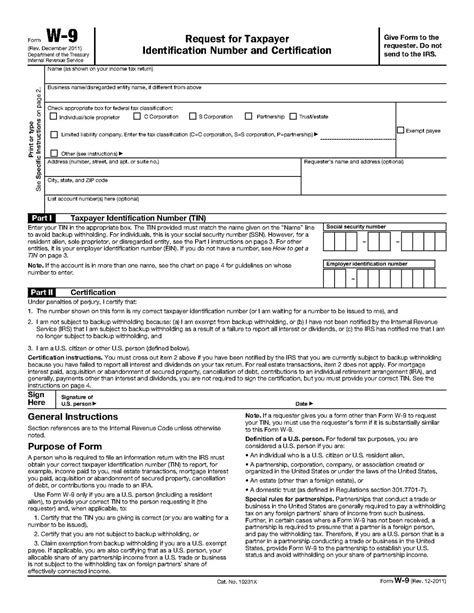

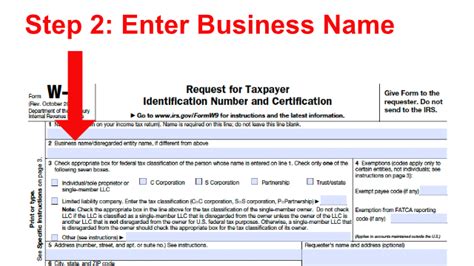

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by businesses to collect necessary information from vendors, freelancers, and independent contractors. This information includes the individual's or business's name, address, taxpayer identification number (such as a Social Security number or Employer Identification Number), and certification that they are not subject to backup withholding. The W9 form is typically required when an individual or business earns more than $600 in a calendar year from a single client.

Having a W9 form printable can be beneficial for several reasons. Firstly, it allows businesses to quickly and easily obtain the necessary information from their vendors and contractors, streamlining the onboarding process. Secondly, it provides a standardized format for collecting this information, reducing the risk of errors or missing data. Finally, having a printable W9 form can help businesses stay organized and compliant with tax regulations, reducing the risk of audits or penalties.

Benefits of Using a W9 Form Printable

Using a W9 form printable can offer several benefits for businesses and individuals. Some of the key advantages include:

- Convenience: A W9 form printable allows businesses to quickly and easily access the necessary form, without having to search for it online or wait for a physical copy to arrive.

- Standardization: The W9 form provides a standardized format for collecting taxpayer identification information, reducing the risk of errors or missing data.

- Compliance: Using a W9 form printable can help businesses stay compliant with tax regulations, reducing the risk of audits or penalties.

- Organization: Having a printable W9 form can help businesses stay organized, keeping all necessary documents in one place.

How to Obtain a W9 Form Printable

Obtaining a W9 form printable is relatively straightforward. The most common method is to download the form from the official IRS website. The IRS provides a downloadable version of the W9 form in PDF format, which can be easily printed and completed. Alternatively, businesses can purchase a W9 form printable from an office supply store or online retailer.

5 Ways to Use a W9 Form Printable

Here are five ways to use a W9 form printable:

- Onboarding new vendors or contractors: A W9 form printable can be used to collect necessary information from new vendors or contractors, streamlining the onboarding process.

- Updating existing vendor or contractor information: A W9 form printable can be used to update existing information for vendors or contractors, ensuring that all data is accurate and up-to-date.

- Complying with tax regulations: Using a W9 form printable can help businesses stay compliant with tax regulations, reducing the risk of audits or penalties.

- Organizing tax documents: A W9 form printable can be used to keep all necessary tax documents in one place, making it easier to manage and file taxes.

- Auditing and verifying vendor or contractor information: A W9 form printable can be used to audit and verify vendor or contractor information, ensuring that all data is accurate and compliant with tax regulations.

Best Practices for Using a W9 Form Printable

When using a W9 form printable, there are several best practices to keep in mind. These include:

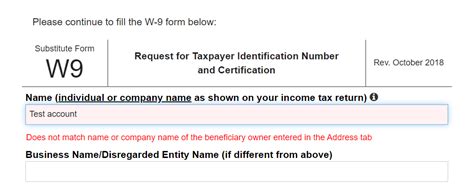

- Ensuring accuracy: It's essential to ensure that all information collected on the W9 form is accurate and complete.

- Using the most up-to-date version: Businesses should always use the most up-to-date version of the W9 form, as tax regulations and requirements can change.

- Storing completed forms securely: Completed W9 forms should be stored securely, with access restricted to authorized personnel.

- Updating information regularly: Businesses should regularly update vendor or contractor information to ensure that all data is accurate and up-to-date.

Common Mistakes to Avoid When Using a W9 Form Printable

When using a W9 form printable, there are several common mistakes to avoid. These include:

- Using an outdated version of the form: Businesses should always use the most up-to-date version of the W9 form, as tax regulations and requirements can change.

- Failing to collect complete information: It's essential to ensure that all information collected on the W9 form is complete and accurate.

- Not storing completed forms securely: Completed W9 forms should be stored securely, with access restricted to authorized personnel.

- Not updating information regularly: Businesses should regularly update vendor or contractor information to ensure that all data is accurate and up-to-date.

W9 Form Image Gallery

What is a W9 form used for?

+A W9 form is used to collect necessary information from vendors, freelancers, and independent contractors, including their name, address, taxpayer identification number, and certification that they are not subject to backup withholding.

How do I obtain a W9 form printable?

+The most common method is to download the form from the official IRS website. The IRS provides a downloadable version of the W9 form in PDF format, which can be easily printed and completed.

What are the benefits of using a W9 form printable?

+Using a W9 form printable can offer several benefits, including convenience, standardization, compliance, and organization. It allows businesses to quickly and easily access the necessary form, reduces the risk of errors or missing data, and helps businesses stay compliant with tax regulations.

In conclusion, having access to a W9 form printable can be incredibly beneficial for businesses and individuals alike. By understanding the importance of the W9 form, the benefits of using a printable version, and how to obtain one, businesses can streamline their onboarding process, stay compliant with tax regulations, and reduce the risk of audits or penalties. We encourage you to share your thoughts and experiences with using W9 forms in the comments below. If you found this article helpful, please consider sharing it with others who may benefit from this information.