Intro

Discover 5 ways bill sales can boost revenue, featuring invoice factoring, accounts receivable financing, and asset-based lending, to improve cash flow and business growth.

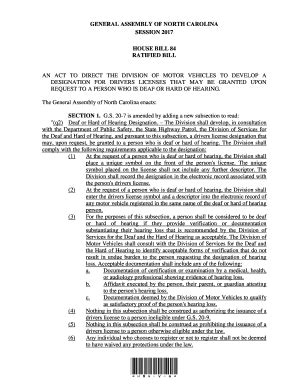

The concept of bill sales has become increasingly popular in recent years, particularly among businesses and individuals looking to improve their financial stability. Bill sales, also known as invoice factoring or accounts receivable financing, involve selling outstanding invoices or bills to a third-party company, which then collects payment from the customers. This financial strategy can provide numerous benefits, including improved cash flow, reduced bad debt, and increased working capital. In this article, we will explore five ways bill sales can benefit individuals and businesses, as well as provide an in-depth examination of the process and its advantages.

Bill sales can be a valuable tool for companies looking to manage their finances more effectively. By selling their outstanding invoices, businesses can receive immediate payment, which can be used to cover expenses, invest in new projects, or pay off debts. This approach can be particularly useful for small businesses or startups that may not have the resources to wait for payment from their customers. Additionally, bill sales can help companies reduce their bad debt, as the third-party company assumes the risk of non-payment.

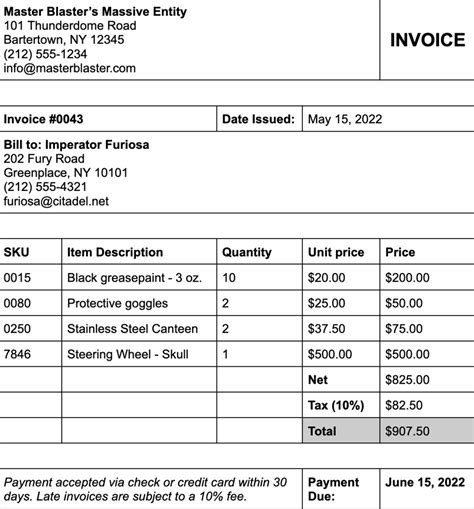

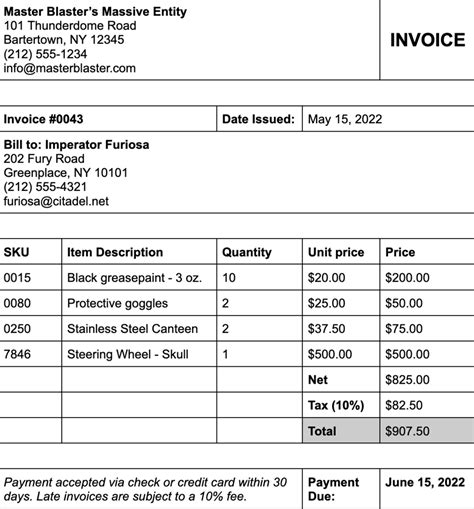

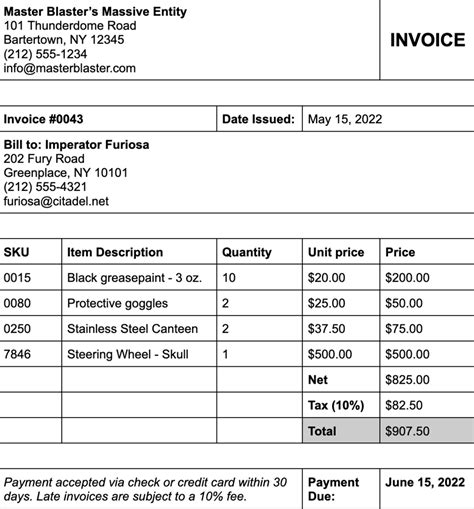

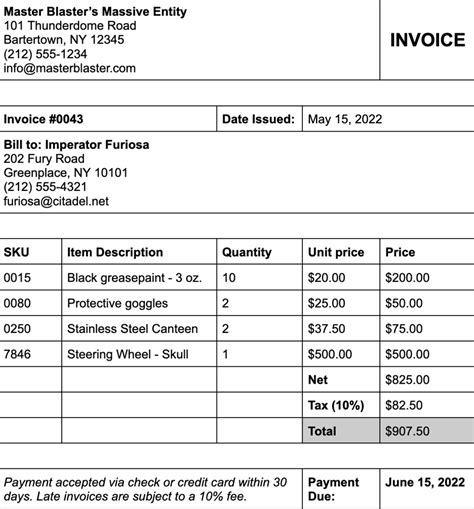

The process of bill sales is relatively straightforward. A business will typically submit its outstanding invoices to a factoring company, which will then verify the invoices and assess the creditworthiness of the customers. Once the invoices are approved, the factoring company will advance a percentage of the invoice value to the business, usually within 24 hours. The factoring company will then collect payment from the customers and return the remaining balance to the business, minus a fee.

Benefits of Bill Sales

The benefits of bill sales are numerous and can have a significant impact on a company's financial stability. Some of the most significant advantages include improved cash flow, reduced bad debt, and increased working capital. By selling their outstanding invoices, businesses can receive immediate payment, which can be used to cover expenses, invest in new projects, or pay off debts. This approach can be particularly useful for small businesses or startups that may not have the resources to wait for payment from their customers.

Improved Cash Flow

Improved cash flow is one of the most significant benefits of bill sales. By selling their outstanding invoices, businesses can receive immediate payment, which can be used to cover expenses, invest in new projects, or pay off debts. This approach can be particularly useful for small businesses or startups that may not have the resources to wait for payment from their customers. With improved cash flow, companies can better manage their finances, make timely payments to suppliers, and invest in growth opportunities.Reduced Bad Debt

Bill sales can also help companies reduce their bad debt. When a business sells its outstanding invoices to a factoring company, the factoring company assumes the risk of non-payment. This means that if a customer fails to pay an invoice, the factoring company will absorb the loss, rather than the business. This approach can be particularly useful for companies that have a high volume of outstanding invoices or that operate in industries with a high risk of non-payment.

Increased Working Capital

Increased working capital is another significant benefit of bill sales. By selling their outstanding invoices, businesses can receive immediate payment, which can be used to invest in new projects, hire additional staff, or purchase equipment. This approach can be particularly useful for small businesses or startups that may not have the resources to wait for payment from their customers. With increased working capital, companies can better manage their finances, make timely payments to suppliers, and invest in growth opportunities.Types of Bill Sales

There are several types of bill sales, each with its own advantages and disadvantages. Some of the most common types of bill sales include:

- Invoice factoring: This involves selling outstanding invoices to a factoring company, which then collects payment from the customers.

- Accounts receivable financing: This involves using outstanding invoices as collateral to secure a loan from a bank or other financial institution.

- Asset-based lending: This involves using outstanding invoices, as well as other assets such as equipment or property, as collateral to secure a loan from a bank or other financial institution.

How to Choose the Right Type of Bill Sales

Choosing the right type of bill sales depends on several factors, including the size and type of business, the volume of outstanding invoices, and the creditworthiness of the customers. Businesses should carefully consider their options and choose a type of bill sales that meets their specific needs and goals. It is also essential to research and compares different factoring companies and their fees, terms, and conditions.Best Practices for Bill Sales

To get the most out of bill sales, businesses should follow best practices, including:

- Carefully reviewing and understanding the terms and conditions of the factoring agreement

- Ensuring that the factoring company is reputable and has a good track record

- Providing accurate and complete information about the outstanding invoices and customers

- Maintaining good communication with the factoring company and customers

- Regularly reviewing and updating the factoring agreement as needed

Common Mistakes to Avoid

There are several common mistakes that businesses should avoid when using bill sales, including:- Failing to carefully review and understand the terms and conditions of the factoring agreement

- Choosing a factoring company that is not reputable or has a poor track record

- Providing inaccurate or incomplete information about the outstanding invoices and customers

- Failing to maintain good communication with the factoring company and customers

- Failing to regularly review and update the factoring agreement as needed

Conclusion and Future Outlook

In conclusion, bill sales can be a valuable tool for businesses looking to improve their financial stability. By selling their outstanding invoices, companies can receive immediate payment, reduce bad debt, and increase working capital. However, it is essential to carefully consider the options and choose a type of bill sales that meets the specific needs and goals of the business. By following best practices and avoiding common mistakes, businesses can get the most out of bill sales and achieve long-term financial success.

Future Outlook

The future outlook for bill sales is positive, with the market expected to continue growing in the coming years. As more businesses become aware of the benefits of bill sales, the demand for factoring services is likely to increase. Additionally, advancements in technology are making it easier for businesses to access factoring services and manage their finances more effectively.Bill Sales Image Gallery

What is bill sales and how does it work?

+Bill sales, also known as invoice factoring or accounts receivable financing, involves selling outstanding invoices to a third-party company, which then collects payment from the customers.

What are the benefits of bill sales?

+The benefits of bill sales include improved cash flow, reduced bad debt, and increased working capital.

How do I choose the right type of bill sales for my business?

+Choosing the right type of bill sales depends on several factors, including the size and type of business, the volume of outstanding invoices, and the creditworthiness of the customers. Businesses should carefully consider their options and choose a type of bill sales that meets their specific needs and goals.

What are the common mistakes to avoid when using bill sales?

+Common mistakes to avoid when using bill sales include failing to carefully review and understand the terms and conditions of the factoring agreement, choosing a factoring company that is not reputable or has a poor track record, and failing to maintain good communication with the factoring company and customers.

What is the future outlook for bill sales?

+The future outlook for bill sales is positive, with the market expected to continue growing in the coming years. As more businesses become aware of the benefits of bill sales, the demand for factoring services is likely to increase.

We hope this article has provided you with a comprehensive understanding of bill sales and its benefits. If you have any further questions or would like to learn more about how bill sales can help your business, please do not hesitate to contact us. We invite you to share your thoughts and experiences with bill sales in the comments section below. Additionally, if you found this article informative and helpful, please share it with your network to help spread the word about the benefits of bill sales.